Quarterly Newsletter: Feeling fearful when markets turn? Time for a risk reality check

Feeling fearful when markets turn? Time for a risk reality check

Depending on your age and investing experience, the market downturn in March caused by the COVID-19 crisis may have been a real shock or just the latest in a series of unfortunate events in your investing life. Either way, these types of market gyrations bring to the fore our personal relationship with risk. While we may understand risk as a concept,

especially easy to do when the markets are up, it takes a serious downturn to face our emotional reactions to risk. If you’ve been feeling anxious, it may be time to reevaluate your tolerance for risk.

The risk/return relationship

Every type of investment carries some kind of risk. Even if you choose not to invest, you experience what we call opportunity risk – because you could have made more money by investing than by staying on the sidelines. Lower-risk or guaranteed investments, such as Guaranteed Investment Certificates (GICs), may protect capital, but you trade off any chance of significant potential for growth. Over time, this could mean falling short of your goals. To compensate, you may need to save more, spend less, generate more income, or delay the achievement of your objective (for example, retiring at 65 instead of 60). Investments like equities can offer greater returns, but these come with higher-risk profiles. Keep in mind there is a wide variety of equities to consider across a broad risk

spectrum. Quality, blue-chip companies with a history of price growth that pay dividends and have good prospects will fall lower on the spectrum. Conversely, stocks in companies that have newer products, operate in more volatile markets, or are denominated in foreign currencies all carry greater – and different kinds of – risks. These have the potential for very high rates of returns, but you need to assess whether these are appropriate for your portfolio

given your objectives. Remember, too, that risks can be managed. For example, holding a portfolio of diversified investments helps to reduce the impact of a temporary downturn in any one investment category.

Keep perspective

It’s human nature to overestimate our ability to handle risk when times are good – and to be exceedingly fearful after a big loss. That’s why it’s essential to focus on your portfolio as a whole and keep your investing goals and time horizon in mind. At the end of the day, your portfolio should take enough risk to help generate the returns needed to meet your long-term objectives – but not so much as to make you uncomfortable. If you’re ever feeling uneasy, let’s talk.

Time to revisit your emergency fund

How much?

A general rule of thumb is to have enough money to cover between three and six months’ worth of expenses. The right amount for you and your family will depend on your personal circumstances. If your household has only one income, then you are more susceptible to the risk of losing that income. If some of your expenses are flexible and you could cut back on your spending easily, you may have more leeway.

Where to keep it?

You’ll want to keep these emergency funds in highly liquid investments – meaning that you can have access to the funds quickly and easily. Options to consider include High-Interest Savings Accounts, cashable Guaranteed Investment Certificates (GICs) or Money Market mutual funds

Can you borrow?

In recent years, an alternative idea has been to think of your Home Equity Line of Credit (HELOC) as a kind of emergency fund, as you may have access to the equivalent of three to six months of living expenses by borrowing from it. This is a riskier strategy, as your HELOC agreement may allow the lender to alter the terms and the interest of the loan at their discretion. Many HELOCs also allow the lender to ask for full repayment on demand – an unlikely, but possible, scenario. Keep in mind, too, that you’re adding to your overall debt burden at a time of financial stress.

Get started

Don’t let the “six months of expenses” target dissuade you from getting started on building your fund. Any amount of savings could help you get over a difficult patch. A little regular saving now could be a big help when you really need it.

The four cornerstones of your estate plan

Are you waiting to be wealthy enough, or old enough, to think about having an estate plan? Do not wait, because estate planning is a fundamental part of establishing financial security for all Canadians. Your estate plan ensures that the right people are designated to make important decisions when you can’t, and that your property can be efficiently passed on to those you want to receive it.A solid estate plan rests on four cornerstones: your will, a power of attorney for property, a power of attorney for medical care, and a life insurance strategy.

1. Your will.

According to several recent surveys, only about half of Canadians have a signed will. Your will sets out how your assets are to be distributed after death, and names one or more executors (called estate trustees in Ontario; liquidators in Quebec) to wind up your affairs. If you die without a will, provincial law dictates the distribution of your wealth among your relatives without regard to need and with no provision for friends and relatives beyond your immediate family. It’s best to have your will drawn up professionally to make sure that all “what-ifs” are covered and that your wishes conform to the law of your province.

2. Power of attorney for property.

This document names one or more trusted people to make decisions about your assets and liabilities if you should become incapacitated. You might assume that your spouse can simply take over if you become incapable of making decisions. That’s immediately true only if your spouse is named in a power of attorney. Otherwise, your affairs may be tied up until a court or a provincial public trustee decides that your spouse is fit for the job.

3. Power of attorney for medical care.

This document is also known as a medical directive or living will (known as a mandate of incapacity or protection mandate in Quebec). It is often prepared at the same time as your will. It indicates who should make decisions about medical care and how far doctors should go to prolong your life. The goal is to clearly indicate your wishes and avoid arguments that could tear apart your loved ones.

4. A life insurance strategy.

Complete estate planning should include seeking advice from a licensed Life Insurance professional. A life insurance strategy is designed to protect your family’s lifestyle if you die prematurely. That need may end or diminish once children are grown, but you might still want coverage for debts, as well as taxes due at death. Life insurance can also fund a significant bequest to one or more favoured charities.

Stay current

If you don’t have an estate plan in place, now is the time to get started. And remember, life changes such as marriage, divorce, children, or a change in financial circumstances should lead to a review of your plan. Keep in mind that moving to another province may also lead to a review as, in Canada, estate law is a provincial matter.

U.S. companies dominate many sectorsShould they be in your portfolio too?

As the largest economy in the world, the United States is an economic powerhouse. It attracts the attention and capital of investors across the globe. It’s not just because the U.S. is a large market of almost 330 million consumers with a high standard of living. The U.S. is home to some of the largest and most successful companies in the world, many of them with a global presence. In fact, in many sectors American firms dominate and investors looking to buy into those sectors will find it impossible to ignore these U.S.-based companies.

How big is big?

The U.S. capital markets are the deepest and most liquid in the world. That liquidity, meaning that shares can be bought and sold freely, provides investors with more choices of stocks and securities across many sectors than anywhere else. American markets also feature a regulatory framework supporting transparency and investor protection. Just how big are they? The New York Stock Exchange (NYSE) is the largest in the world and accounts for roughly 40% of the world’s stock market capitalization. In second place is U.S.-based NASDAQ, home to some of the largest technology companies on the planet. The U.S. corporate bond market is also the world’s largest.

Sector dominance

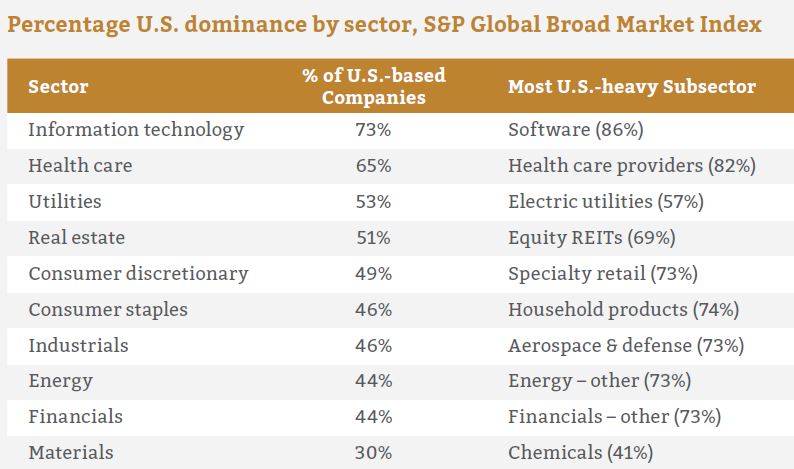

This market heft is demonstrated in the dominance of many key sectors by U.S. companies, including sectors in demand by investors (see table this page based on the S&P Global Broad Market Index1). Consider these:

Technology:

The dominance of U.S. firms in tech is well known. In 2019, seven out of 10 of the largest technology companies in the world were American.2 As the table shows, this pre-eminence is especially strong in software, with 86% of the sector in the index being U.S. owned.

Health Care:

Over $7.8 trillion (USD) a year is spent on health care globally. Nearly half of that total – $3.5 trillion – is spent in the United States.3 It’s no surprise, then, that American firms hold sway in this sector too, with an especially strong presence in the Health Care Provider and Biotech areas.

Consumer Segments:

With its large, affluent market and powerful brands, the United States is home to some heavy hitters providing products and services to the consumer market. U.S. companies making household products dominate their sector, and American specialty retailers hold supremacy in their space.It’s easy to see why investors are so attracted to American investments, whether it’s for the steady performance of consumer staples or the high growth potential of technology or biotech. With their global dominance, many U.S. firms also provide global exposure for a portfolio, as they may operate or generate revenue in hundreds of countries.

Easy access:

For Canadians, the most common way to access the U.S. market is through mutual funds or exchange-traded funds (ETFs). It will be obvious if you own a U.S. or North American equity fund that you have such exposure. However, what this heavy dominance in key sectors suggests is that you’ll likely have even more exposure in other funds as well. Many global funds, depending on their mandate, will likely include a high number of U.S. companies. Specialty funds that concentrate on technology, health care or financial services will also have a big American presence. Chances are these global leaders are already working for you in your portfolio. If you’d like to understand more about your access to these sectors or the role they play in your portfolio, let’s review your investment strategy soon.

Where America dominates

One of the key benefits of investing in the U.S. is to gain access to sectors that are underrepresented in our own country’s stock market. As this chart shows, in sectors such as IT, software, and health care, American companies really dominate.

TFSAs provide flexibility when withdrawing cash and when re-investing it

The Tax-free Savings Account’s (TFSA) withdrawal provisions are ideal when you need to tap your savings, as many of us were reminded during the COVID-19 pandemic. The good news is that they also allow us to put money back in easily. But keep the rules in mind or face the tax consequences.

TFSAs are a useful savings vehicle: Any amount contributed as well as any income earned in the account, such as interest income or capital gains, is generally tax-free, even when it is withdrawn. Plus, there are no restrictions on the amount or the timing of your withdrawals.

Even better, when you withdraw funds from your TFSA, you do not lose your contribution room and you can put that money back in. But there are rules regarding re-contributions.

Generally, the rule is that the amount of your withdrawal from your TFSA will be added back to your TSFA contribution room the following year. If you want to replace the money you withdrew, you’ll need to wait for the new year. The exception is that if you have unused contribution room from previous years, you can replace that money sooner as long as you stay within your available contribution room.

Millennials eye recreational property for enjoyment and investment

Millennials are more likely than their Boomer parents to be interested in recreational property for its investment potential, and their interest in buying a cottage has taken a big jump. A 2019 report from a major real estate brokerage found a 14% increase in the percentage of Millennials interested in purchasing a recreational property, to 56%, compared to 40% of Canadians overall.

Price remains the top consideration for recreational property buyers of all ages, with 61% of survey respondents naming affordability as the most important factor. However, Millennials have different lifestyle and property criteria than those of their Boomer counterparts, with factors like Internet connectivity, recreational activities, and proximity to towns with urban conveniences being more important selling features.

Some Millennials may be considering a recreational property as their first home purchase to avoid high condo and house prices in the city where they live. With a drop in supply, especially in Ontario and Quebec, and increased competition from wealthier Boomers nearing retirement, Millennials may find that “buying low” will be almost impossible for their cottage investment.

Most Canadians want their financial advice from a human being

Three quarters of Canadian investors say they want financial advice to come from a human, according to new research from the Investment Industry Regulatory Organization of Canada (IIROC).

Are we talking digital dinosaurs here? Not at all. While the survey found that 79% of current investors are comfortable doing financial business online – witness the widespread popularity of online banking – less than 20% have tried automated investment services.

Respondents seem to value the personalized service they perceive coming from a real person. Just 40% thought that automated investment services provide services that are “personalized.” They also want their financial advisor to take into account their immediate family as part of the investment planning process.

As for the digital services, investors said they are concerned about “privacy and security” and worried that regulatory standards might not be as high.

As more and more of our lives move online, for now at least, it seems we value the personal touch when it comes to managing our money.